Unlike the deposit method, the FXOpen withdrawal method is divided into three main categories: wire transfer, credit card, and e-payment. However, there are main conditions that you need to pay attention to before making a withdrawal from all methods: Your account must be verified. Regarding the FXOpen account verification guide, you can learn it on this page.

Apart from that, it's a good idea to choose the same withdrawal method as the deposit method. There are no specific prohibitions, but there is a certain time limit if it is not done according to the deposit method in certain withdrawal methods.

A. FXOpen Withdrawal Guide With Wire Transfer

This method can process withdrawals of trading funds between bank accounts. So that the process runs smoothly, make sure that the account name in the eWallet (Member Area) is the same as the name on your bank account. Apart from matching name identity, here are several conditions that need to be considered:

- Currency types: USD, EUR, GBP, AUD, CHF, RUB, JPY.

- Processing time: Maximum three working days.

- Minimum withdrawal : 100 USD.

- Maximum withdrawal: No limit.

- Fee : 0 USD/EUR/CHF/AUD, 25 GBP, 1500 RUB, or 3000 JPY.

Withdrawal steps :

- Go to the FXOpen site.

- Login to MyFXOpen Member Area.

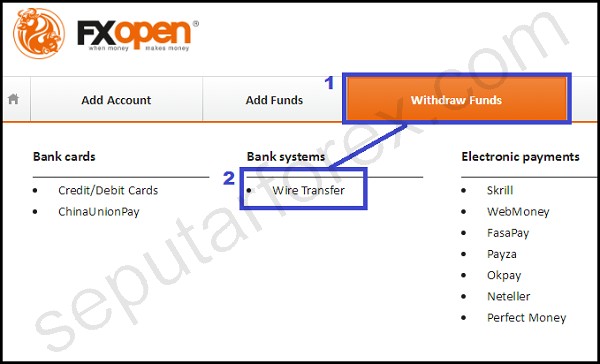

- Select the "Withdraw funds" menu, then click "Wire Transfer".

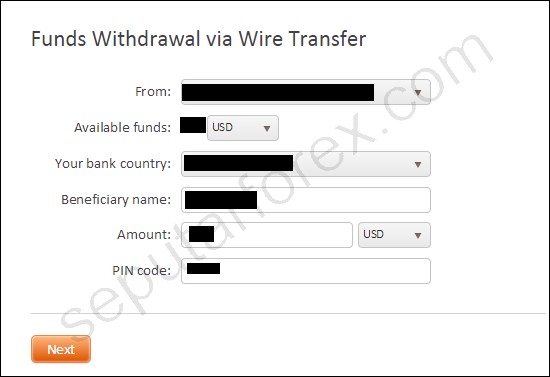

- Complete the following withdrawal form according to the instructions:

From : This is your eWallet account number. This data usually appears on the left side of the Member Area page. Available funds : The amount of funds remaining in your account. Your bank country : The country where your bank operates. Beneficiary name : Your bank account name. Amount : The amount of funds to be disbursed. PIN code : eWallet PIN code. This data includes the one you received when you first registered for an account. - Click "Next".

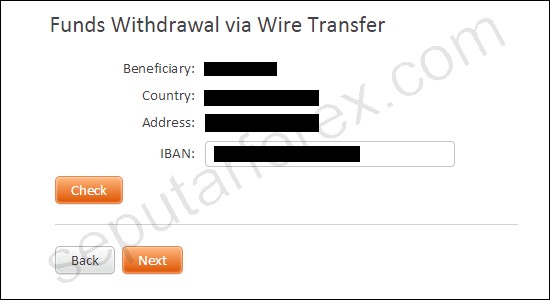

- Next, there will be a page containing your name and place of residence. Enter your bank's IBAN or SWIFT code in the IBAN column, then click "Check".

- After confirming the correctness of the data, press the "Next" button to continue.

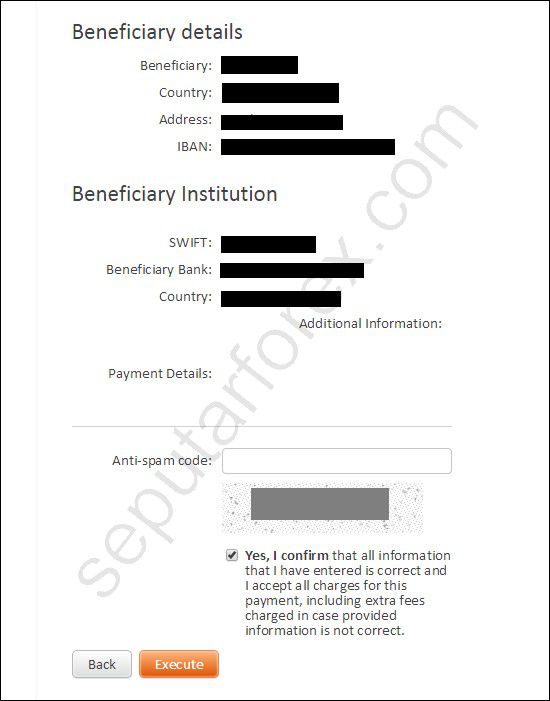

- Confirm your identity and bank data again -> enter the anti-spam code according to the instructions -> check the confirmation box -> then click "Execute.

- FXOpen will send a message to your email. So next, check your email inbox and click the confirmation link in the FXOpen message.

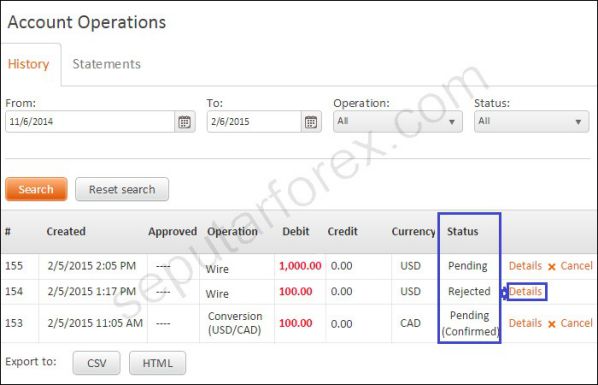

- Your withdrawal data will be recorded in the "History" list with the "Pending Confirmed" status.

- FXOpen broker will analyze your withdrawal request. When finished, the funds will be immediately transferred to your account, and the withdrawal status will change to "Succeed".

- This withdrawal process is estimated to take a maximum of 3 working days. If, within this time limit, your funds have not been received, please check the "History" column in the "Account Operations" section in the Member Area. If it's still Pending, you haven't clicked the confirmation button in your email inbox. If the status is Rejected, you can see the reason by opening "Details" in the history log.

B. FXOpen Withdrawal Guide With Credit/Debit Card

In the FXOpen withdrawal method via credit/debit card, there are 3 main things you need to pay attention to:

- Withdrawals from funds deposited with a credit/debit card can be made anytime.

- If you previously deposited via credit/debit card but then used another method (wire transfer/e-payment) when withdrawing profits, you need to wait a minimum of 30 days after the deposit to be able to start the withdrawal process.

- If you use various types of credit/debit cards for deposits, the processing time and stages will be specifically determined by the FXOpen Financial department when withdrawing profits.

Meanwhile, in general, these are the conditions for FXOpen withdrawals via Visa or MasterCard:

- Currency type: USD, EUR, RUB.

- Processing time: From FXOpen 24 hours, while transferring funds to the card can take 3-5 working days depending on the bank's operations that issued your card.

- Minimum withdrawal: 8 EUR or 10 USD.

- Maximum withdrawal: 2000 USD.

- Fee: For EUR or USD withdrawals, the fee is up to 2% (min. 6.5 EUR or 7.5 USD). Meanwhile for RUB, the fee reaches 2.5% + 50 RUB.

Withdrawal steps :

- Go to the FXOpen homepage.

- Login to MyFXOpen Member Area.

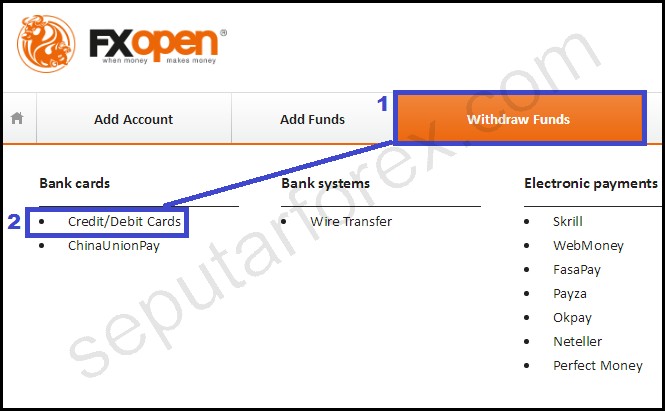

- Select the "Withdraw funds" menu, then click "Credit/Debit Cards".

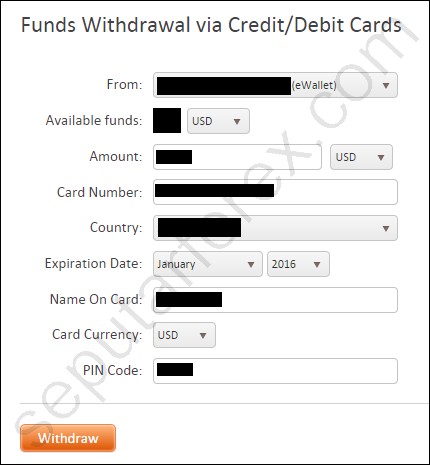

- Complete the following withdrawal form with the required data.

- Click "Withdraw".

- FXOpen will send a confirmation email. Immediately check your email inbox, then click the confirmation link included in the FXOpen email to change the withdrawal status to "Pending Confirmed".

- FXOpen will review your withdrawal request. If there are no problems, the request will be approved, and your funds will be immediately sent to your Visa/MasterCard card.

- If successful, your withdrawal status in the "History" section will change to "Succeed".

C. FXOpen Withdrawal Guide With E-Payment

Various well-known e-payments that are most widely used, such as WebMoney, Neteller, Skrill, FasaPay, and Perfect Money, can be chosen as your withdrawal method. The withdrawal process using e-payment is one of the easiest and cheapest, as can be seen from the following conditions:

- Currency type :

- WebMoney : USD, EUR, RUB

- Neteller : USD, EUR, AUD, GBP, JPY, RUB, SGD

- Skrill : USD, EUR, GBP, CHF, CAD, AUD, JPY

- FasaPay : USD, IDR

- Perfect Money : USD

- Processing time : Maximum 24 hours.

- Minimum withdrawal :

- WebMoney : 1 USD (WMZ), 0.7 EUR (WME), 15 RUB (WMR)

- Neteller/Skrill/FasaPay/Perfect Money : 1 USD

- Skrill/FasaPay/Perfect Money : 1 USD

- Maximum withdrawal : There is no limit except for Neteller which is set at a maximum of 10,000 USD.

- Fees :

- WebMoney: 0.8%.

- Neteller: None.

- Skrill:1% (maximum 0.68 USD).

- FasaPay: 0.5%.

- Perfect Money: 0.5%.

Withdrawal steps :

- Open the FXOpen website

- Login to MyFXOpen Member Area.

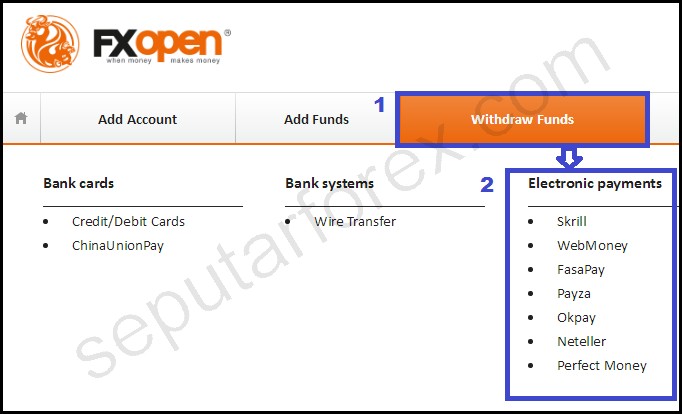

- Select the "Withdraw funds" menu, then click the e-payment of your choice.

- Complete the deposit form according to the instructions. Instructions for filling in this column may vary depending on your e-payment method.

- Click "Withdraw".

- Please check your email inbox. FXOpen will send a confirmation email along with a special link.

- Click the link to change your withdrawal status to "Pending Confirmed".

- After FXOpen approves the withdrawal request, the funds will immediately be sent to your e-payment account. This process is estimated to take no more than 24 hours. If problems prevent your funds from arriving by the deadline, please check the withdrawal status in the "History" table. You may have not confirmed via email or your request has been rejected by FXOpen. If the request is rejected, you can learn the reason in "Details" in the "History" table, or ask directly to the FXOpen broker's CS.

Converting E-payments to Rupiah

After completing the withdrawal process, the funds will only go into your e-payment account. To be able to withdraw it in Rupiah, you need to make a withdrawal from your e-payment (selling) account via a local exchanger. If you use WebMoney or FasaPay e-payment, a solution from an exchanger provides WebMoney and FasaPay online buying and selling services.

Conclusions and recommendations

The withdrawal guide above shows that the e-payment method is again the favorite choice for the fastest, easiest and cheapest withdrawal process. However, you can also choose the credit/debit card method if you already have a credit card and are familiar with using it online, or choose a wire transfer if you prefer to use the conventional method. Whatever your considerations, the most important thing is to make sure the account is verified and it is best to use the same deposit and withdrawal method to increase transaction ease.

FXOpen is an experienced broker with the advantages of ECN accounts, swap-free, various trading contests, and liquidity transparency. This broker is also one of the pioneers in crypto CFD trading.

FXOpen is an experienced broker with the advantages of ECN accounts, swap-free, various trading contests, and liquidity transparency. This broker is also one of the pioneers in crypto CFD trading.