For those of you who have registered an account and want to start real trading on FXOpen, you must first top up your funds through the deposit process. FXOpen broker provides many payment methods, which can be classified into 3 main types; wire transfer, credit card, and e-payment. The following is a deposit guide for each payment method category at FXOpen.

A. FXOpen Deposit Guide With Wire Transfer

This method can process deposits electronically between bank accounts. The main requirement to be able to top up your account via wire transfer is that your FXOpen account must be verified . The account verification guide can be seen on the page: Guide to Opening a Real FXOpen Account . Apart from that, some conditions worth paying attention to are:

- Currency types : USD, EUR, GBP, AUD, CHF, JPY, RUB.

- Processing time : 1-3 working days.

- Minimum deposit : 25 USD.

- Maximum deposit : no limit.

- Fee : Depends on your bank.

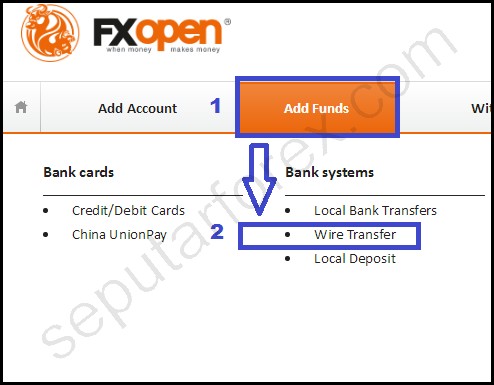

Deposit steps :

- Go to the FXOpen site.

- Login to MyFXOpen Member Area.

- Select the "Add funds" menu, then click "Wire Transfer".

- Specify your country.

- Complete the following deposit form according to the instructions.

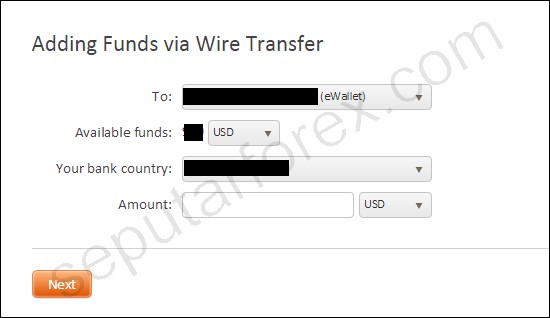

To : This is your eWallet account number. This information usually appears on the left side of the Member Area page. Available funds : The amount of funds remaining in your account. Your bank country : The country where your bank operates. Amount : The amount of funds you want to deposit. - Click "Next".

- Next, you will receive an invoice containing your name, account number, destination bank data, and SWIFT code. Please download the invoice file, then click "Previous" to return to the previous page.

- The invoice data will be valid for the next three days. So, during that period, you can use the invoice to continue the deposit process at the bank office or via internet banking. More complete information about what you must do at this stage can be read on the page: Broker Deposit with Wire Transfer.

- The deposit process has been completed. You can wait for the funds to arrive according to the terms and conditions of this method, which is between 1-3 working days.

- Deposit status can be monitored by clicking on the eWallet account number on the left side of the Member Area page, then looking at the "History" table in "Account Operations".

- If successful, the nominal balance in your account will increase according to the size of the deposit you processed previously. If a problem occurs and the deposit funds have not arrived until after the promised time limit, you can submit a "Notice about payment" claim in the MyFXOpen Member Area.

B. FXOpen Deposit Guide With Credit/Debit Card

Apart from deposit methods between bank accounts, FXOpen provides payment facilities via credit/debit cards. As with the main conditions on Wire, your account must be verified before making an FXOpen deposit transaction via credit/debit card. For those of you who own a MasterCard, Visa, Visa Electron, Maestro, Discover, or JCB credit/debit card, you can follow the following guide to top up funds in your FXOpen account:

- Currency types: USD, EUR, GBP, SCHF, JPY, AUD, CAD, RUB.

- Processing time: Instant.

- Minimum deposit: No conditions.

- Maximum deposit: No conditions.

- Fee: 2.29% + 0.22 (may vary depending on your country and deposit amount).

Deposit steps :

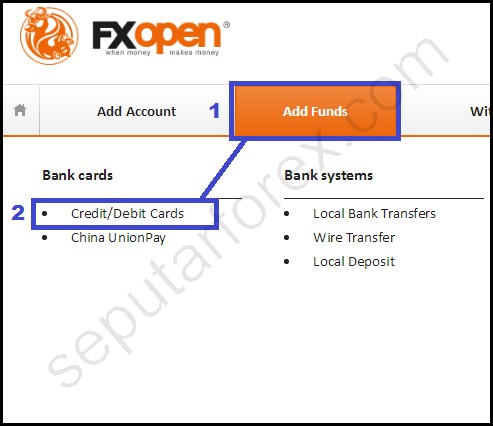

- Go to the FXOpen homepage.

- Login to MyFXOpen Member Area.

- Select the "Add funds" menu, then click "Credit/Debit Cards".

- On the next page, specify your country, currency and card type.

- Click "Next".

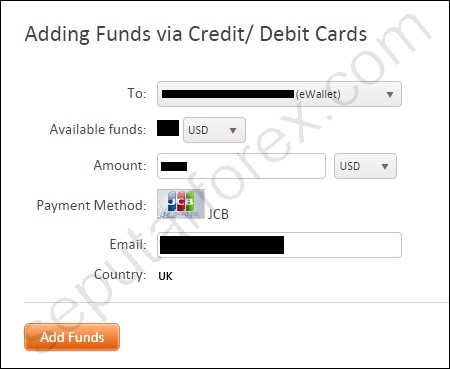

- Fill in the following FXOpen deposit form:

- Press the "Add Funds" button.

- Next, you will be directed to the payment page of your credit/debit card system. Simply complete the form with the requested data, such as card number, expiry date, and card security code, then click "Pay Now" or "Process".

- The deposit process via credit card has been completed. You don't have to wait long with a credit card because FXOpen provides instant service. The status of this deposit can be monitored in the "History" section in "Account Operation". You can also fill in the "Notice About Payment" form if the deposit funds do not enter your trading account immediately.

C. FXOpen Deposit Guide With E-Payment

FXOpen broker provides deposit options with various e-payments, including the most popular types such as WebMoney, Neteller, Skrill, FasaPay, and Perfect Money. Compared to the previous 2 methods, e-payment is a favorite choice for those who want online transactions quickly and cheaply.

However, to use e-payment, you must first create an account on the e-payment website and top up funds there. So, when topping up these funds, you can use the services of a local exchanger who can convert the currency from your bank account (IDR) to USD. Currently various exchanger services in Indonesia are ready to serve these needs, one of which is Kiosinet which provides FasaPay online buying and selling .

The following are detailed deposit conditions that you need to pay attention to:

- Currency Type :

- WebMoney: USD, EUR, RUB

- Neteller: USD, EUR, AUD, GBP, JPY, RUB, SGD

- Skrill: USD, EUR, GBP, CHF, CAD, AUD, JPY

- FasaPay: USD, IDR

- Perfect Money: USD

- Processing time: Instant.

- Minimum deposit :

- WebMoney: 1 USD (WMZ), 1 EUR (WME), 30 RUB (WMR)

- Neteller: 2 USD

- Skrill/FasaPay/Perfect Money: 1 USD

- Maximum deposit : There is no limit except Neteller, which is set at a maximum range of 50,000 USD.

- Fees :

- WebMoney: Maximum 0.8%.

- Neteller : 2.5% + 0.29 USD.

- Skrill: 1.25% + 0.15 to 0.29 units (depending on currency type).

- FasaPay : 0.5% (maximum 5 USD or 50,000 IDR).

- Perfect Money: 0.5%.

Deposit steps :

- Open the FXOpen website

- Login to MyFXOpen Member Area.

- Select the "Add funds" menu, then click the e-payment of your choice.

- Complete the deposit form according to the instructions. Instructions for filling in this column may vary depending on your e-payment method.

- Click "Add Funds".

- If you deposit via Neteller, the process ends here. However, if you use another e-payment, the next step will take you to the payment confirmation page from the e-payment. Please check again whether your deposit data is correct, then log in to your e-payment account in the column provided.

- End the deposit process by clicking the "Confirm Payment" or "Pay Now" button.

- Next, you must wait for the funds to enter your FXOpen account. As with the previous guideline, deposit status can be monitored in the "History" section of "Account Operation". Apart from that, deposit transactions via e-payment are processed instantly, so if a problem occurs and the funds do not arrive on time, you can fill in the "Notice About Payment" form in the Member Area.

Conclusions and recommendations

From the deposit guide above, it can be concluded that the wire transfer method takes longer to process than credit/debit cards and e-payments. However, wire transfer can be considered superior in terms of security. Therefore, depositing via credit/debit card can be an alternative if you already have a credit card. Meanwhile, if you are reluctant to open a credit card and prioritize convenience, speed, and low fees, then e-payment could be the best choice.

FXOpen is an experienced broker with the advantages of ECN accounts, swap-free, various trading contests, and liquidity transparency. This broker is also one of the pioneers in crypto CFD trading.

FXOpen is an experienced broker with the advantages of ECN accounts, swap-free, various trading contests, and liquidity transparency. This broker is also one of the pioneers in crypto CFD trading.