Alpari deposit methods are divided into 3 general methods: deposits via Wire Transfer, Credit/Debit Card, and Electronic Payment System (E-Payment). Each deposit method can be made with a choice of USD and EUR currencies, except for the FasaPay E-Payment method, which allows traders to deposit funds in USD and IDR currencies.

Please note, Alpari has a policy of uploading documents before deposits , to verify your identity and transfer. This step can be done by:

MyAlpari Personal Area Login -> "My Account" Menu -> Upload Document -> Select the Document to upload (according to the document requirements of your chosen deposit method) -> Select the File to upload

A. Alpari Deposit Guide via Wire Transfer

This method allows you to transfer funds to your Alpari account via your bank account. Before starting the deposit process in this way, it is a good idea for you to pay attention to several conditions, such as:

- Processing time: 2-3 working days.

- Commission: Depends on your bank's commission.

- Document requirements: Signed registration form and scanned proof of identity in the form of a passport.

Deposit steps :

- Go to the official Alpari website.

- MyAlpari Personal Area Login.

- Go to the "Fund Transfer" menu, then click "Fund Deposit".

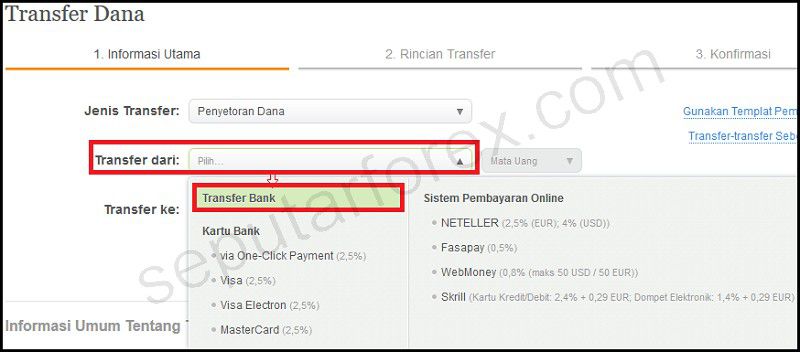

- Select "Bank Transfer" in the "Transfer from" column on the existing deposit form.

- Afterward, select the Alpari Account type in the "Transfer to Alpari Account at Bank" column, the currency, and the type of account you want to fill in in the "Transfer to" section.

- Click "Continue".

- Upload the required documents.

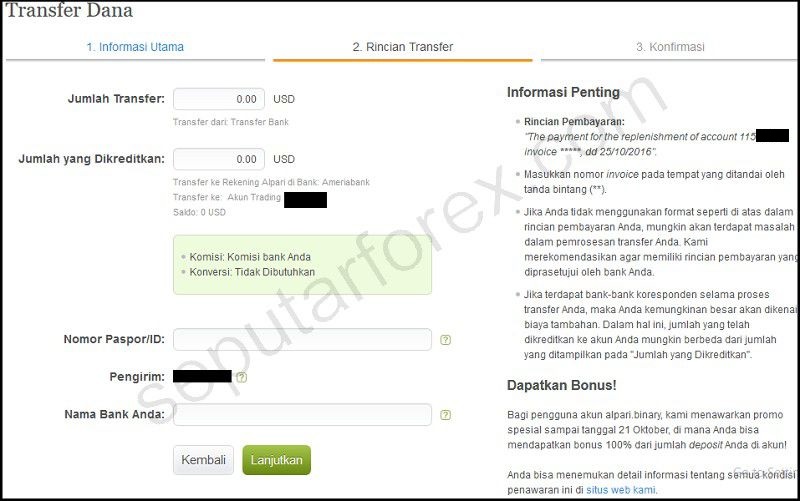

- Fill in the Transfer Details form with information on the Transfer Amount, identity card number (Passport), and name of your bank.

- Select "Continue".

- There will be a recap of your deposit data at the "Confirmation" stage. Please check first whether the information is correct. After that, check the "Save as payment template" box and click "Transfer Funds".

- Make a fund transfer from your bank.

- The deposit process has been completed. You can check the transfer status in the "Funds Transfer History" section of myAlpari.

- If there is a "Successful" status, please log in to the trading platform to confirm the successful deposit of funds ready for you to trade.

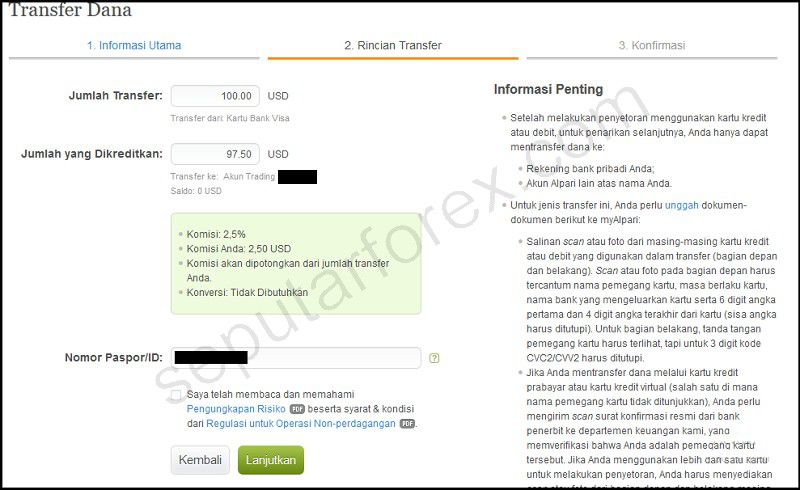

B. Alpari Deposit Guide via Credit/Debit Card

Alpari broker provides deposit routes via Visa and MasterCard credit/debit cards. The following are the deposit conditions:

- Processing time: Several hours.

- Commission: 2.5%.

- Document requirements: Scanned copy of your passport and a scan of the front and back of your credit/debit card.

Deposit steps :

- Go to the official Alpari website.

- Login to myAlpari.

- Go to the "Fund Transfer" menu and click "Fund Deposit".

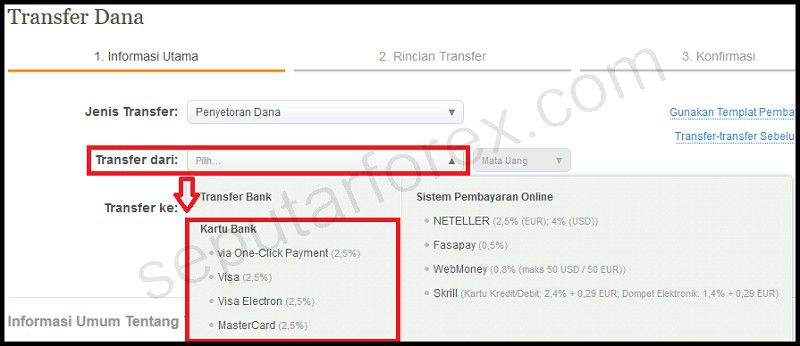

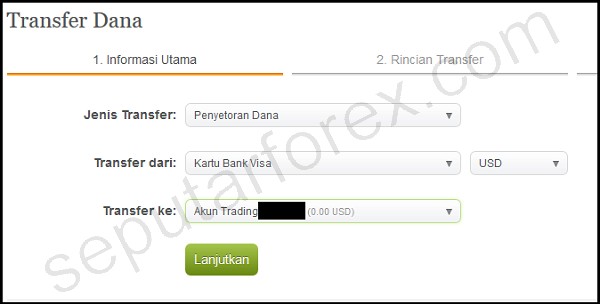

- Select one of the bank card types in the "Transfer from" column.

- Specify the currency and trading account type in the "Transfer To" column.

- Click "Continue".

- Upload the required documents.

- Complete the transfer amount and passport number, and tick the approval box on the Transfer Details form.

- Click "Continue".

- The next stage, confirm your deposit by checking the "Save as payment template" box, then press the "Transfer Funds" button.

- At this point, you have completed the Alpari deposit steps with a credit card. Please open the "Funds Transfer History" section in the Personal Area to monitor deposit status.

- If the status is "Processing", it means your request has been accepted. Once the status changes to "Successful", you can log in to the trading platform to confirm that funds have been posted to your account.

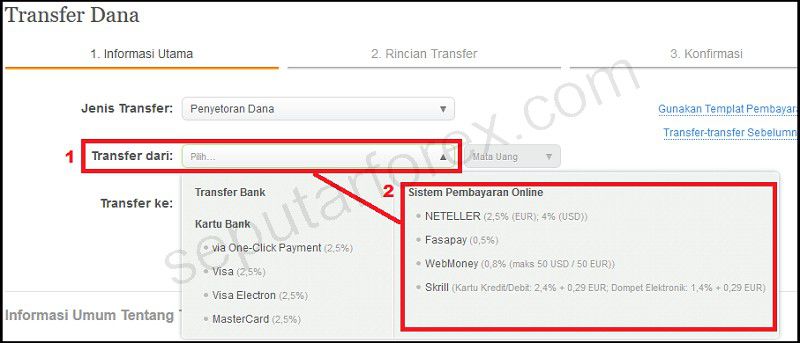

C. Alpari Deposit Guide via E-Payment

Broker Alpari does not forget to offer a deposit option via e-payment, which is generally faster, easier, and cheaper than the two methods above. E-payments available at Alpari include Skrill, Neteller, WebMoney, and FasaPay. Before starting a deposit, of course, you need to open an account first with one of these e-payments.

Apart from that, you must first top up funds to your e-payment (purchase) account to be used as a deposit method to your Alpari trading account. One of the recommended ways to top up is through a local exchanger. This method allows you to top up your account while converting Rupiah to USD via easy transfer between local banks. The guide to buying WebMoney via a local exchanger can be seen directly on this page.

The following are other e-payment deposit conditions that you need to pay attention to:

- Processing time : Immediately.

- Commission :

- Skrill: 2.4% + 0.29 EUR if via credit/debit card, or 1.4% + 0.29 EUR if via Skrill wallet.

- Neteller: 4% if transfer in USD, 2.5% if deposit in EUR.

- WebMoney: 0.8% (maximum 50 USD or 50 EUR).

- FasaPay : 0.5% (minimum 0.01 USD or 100 IDR, maximum 5 USD or 50,000 IDR).

- Document requirements: None, except for deposits via Skrill, which require uploading documents as scanned passports. If Skrill funds are deposited with a credit/debit card, you must also include a scanned copy or photo of your card.

- Deposit amount: Especially for Neteller, there is a maximum deposit limit, which is 37,500 EUR.

Deposit steps :

- Go to the official Alpari website.

- Login to myAlpari.

- Go to the "Fund Transfer" menu and click "Fund Deposit".

- Select one type of e-payment in the "Transfer from" column.

- Next, determine the currency and account type you want to fill in in the "Transfer To" column.

- Enter information on the amount of funds you want to deposit, along with your passport/ID number. If depositing via Neteller, there are additional details in the form of "Neteller Electronic Wallet" and "Security ID or Authentication Code".

- Double-check your deposit data at the Confirmation stage. If correct, check the "Save as payment" box, then click "Transfer Funds".

- If you use Neteller or FasaPay, the deposit process is complete here. However, if you use Skrill, then you still need to complete the deposit process on the Skrill site. Meanwhile, if you use WebMoney, there is a payment confirmation procedure with a special WebMoney application that you need to follow.

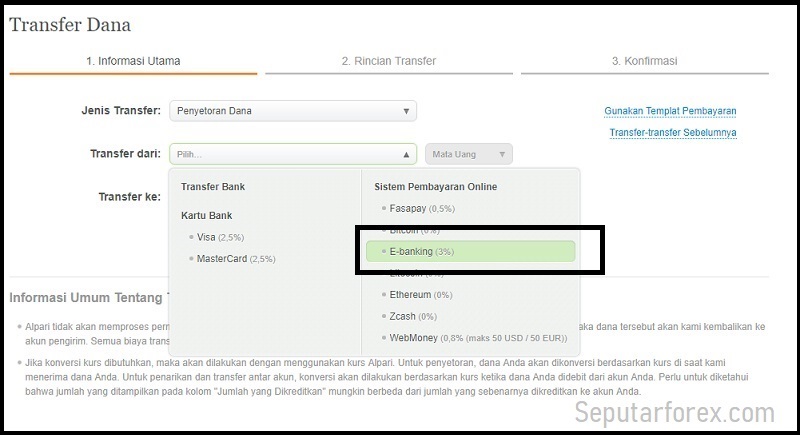

Latest Deposit Methods

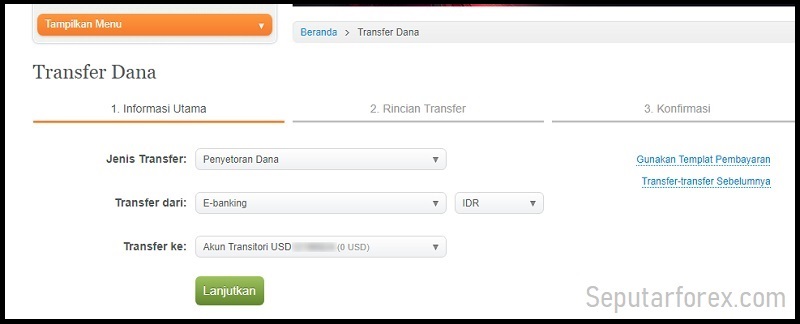

Apart from the deposit methods above, Alpari also introduced the newest deposit method, E-banking. With the E-Banking method supported by Paytrust, traders can make deposits using rupiah.

The following are the conditions for deposits via E-Banking that you need to pay attention to:

- Processing time: Immediately.

- Commission : 3%

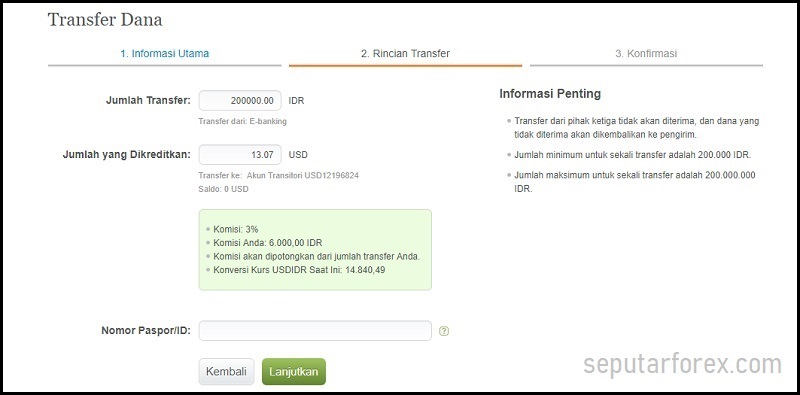

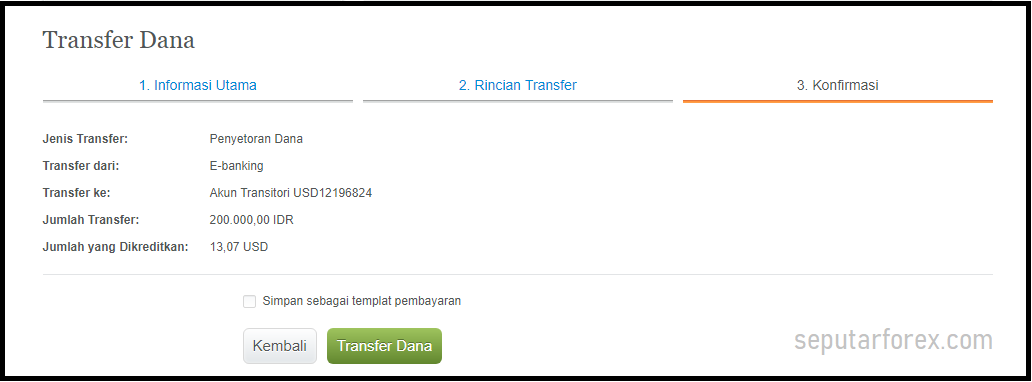

For how to deposit using E-Banking, you can see the image below:

- Select fund transfer

- Select "E-Banking"

- Select the account destination on the "Transfer to" menu, click "continue"

- Enter information on the number of funds you want to deposit, then enter your passport/ID number, click "continue"

- Double check your deposit data at the Confirmation stage. If correct, check the "Save as payment" box, then click "Transfer Funds".

You have finished depositing e-banking supported by Paytrust and are ready to trade with the Alpari broker. If you have any questions or difficulties during this process, visit the official Alpari page for further information.

Alpari was founded in 1998 and is one of the leading brokers in the world. Some of the trading advantages offered include leverage of up to 1:1000, ECN accounts with low commissions, and sophisticated PAMM investment accounts.

Alpari was founded in 1998 and is one of the leading brokers in the world. Some of the trading advantages offered include leverage of up to 1:1000, ECN accounts with low commissions, and sophisticated PAMM investment accounts.